Loan Against Property for Business Funding Needs

A loan against property is a secured business loan that helps companies unlock the value of their property to meet business funding requirements. This funding option is suitable for businesses that need a higher loan amount for working capital, expansion, or long-term financial planning.

With a loan against property, businesses can use their residential or commercial property to access funds while continuing to use the property as usual. The loan comes with structured repayment, longer tenure, and comparatively lower interest rates than unsecured business loans.

If your business needs reliable capital without disturbing daily operations, a loan against property for business can provide the financial stability required to support growth and manage cash flow efficiently.

What is Loan Against Property?

A loan against property is a secured business loan where a company uses its owned property to raise funds for business purposes. The property can be residential or commercial, but the loan amount is used only for business needs such as working capital, expansion, or long-term funding.

In a loan against property, the business pledges the property as security to the lender. Based on the property value and business profile, a loan amount is approved. Even after taking the loan, the business continues to use the property without interruption.

Compared to unsecured business loans, a loan against property for business usually offers a higher loan amount, lower interest rate, and longer repayment tenure. This makes it suitable for businesses that require stable and cost-effective funding.

Simply put, a loan against property allows businesses to unlock the value of their assets and convert it into usable capital while maintaining smooth operations.

Loan Against Property for Business: How It Works

Recent Posts

How Can I Utilise the Loan Against Property?

A loan against property for business works by using an owned property as security to raise funds for business purposes. The business owner offers a residential or commercial property, and the lender evaluates its market value along with the business profile.

Based on this assessment, a suitable business loan against property amount is approved. The loan amount generally depends on factors such as property value, business turnover, repayment capacity, and credit history.

Once approved, the funds are disbursed and can be used for business needs like working capital management, expansion, equipment purchase, or consolidating existing business liabilities. During the loan tenure, the business continues to use the property as usual.

The repayment of a property loan for business happens through fixed monthly instalments over a longer period. This structured repayment makes a loan against property a practical option for businesses looking for stable, long-term funding support.

Types of Loan Against Property

A loan against property for business can be taken in different forms based on the type of property offered as security. Choosing the right type helps businesses get funding that matches their needs and repayment capacity.

Loan Against Residential Property : In this type of loan against property, a residential property owned by the business owner is pledged as security. The funds raised through this option are used strictly for business purposes such as working capital, expansion, or long-term business planning.

Loan Against Commercial Property : A loan against commercial property is taken by pledging assets like shops, offices, warehouses, or industrial units. Since commercial properties usually have higher market value, businesses may qualify for a higher property backed loan amount under this option.

LAP Loan (Property Backed Loan) : An LAP loan is a commonly used term for loan against property in the business loan segment. It refers to any secured property mortgage loan where property value is used to raise funds for business requirements with structured repayment.

Hot Topics

Business Ideas

Business Ideas in Goa

Business Ideas in Rajasthan

Business Ideas in Gujarat

MSME Business Ideas

Each type of loan against property is designed to support business funding needs while offering longer tenure and stable repayment options.

Common Uses of Loan Against Property

A loan against property is mainly used for long-term and high-value business funding needs. Since this is a secured business loan against property, it gives businesses access to larger funds with stable repayment.

One common use of a loan against property for business is working capital support. Businesses use the funds to manage cash flow gaps, vendor payments, salaries, and operational expenses without disturbing daily operations.

Many businesses take a property loan for business to support business expansion. This includes opening new locations, increasing production capacity, or investing in infrastructure and equipment.

A loan against property is also used for debt consolidation, where existing high-interest business loans are merged into a single loan with lower interest and longer tenure.

Some businesses use a property backed loan for long-term financial planning, such as strengthening balance sheets or funding large-scale growth plans.

Overall, a loan against property provides flexible funding that supports business stability and long-term growth.

Loan Against Property Eligibility Criteria

To apply for a loan against property, a business must meet certain eligibility conditions. These criteria help lenders understand the repayment capacity and stability of the business.

The business should be operational for a minimum period, usually a few years. This shows that the business has regular income and continuity.

A stable business turnover and cash flow is important for approval of a business loan against property. Higher and consistent turnover improves eligibility and loan terms.

The property ownership must be clear. The residential or commercial property offered for the loan against property should be owned by the business owner or partners and should have proper legal documents.

A good credit profile of the business or proprietor is also considered. Strong repayment history increases the chances of approval for a property loan for business.

Meeting these eligibility conditions helps businesses access a loan against property smoothly and without unnecessary delays.

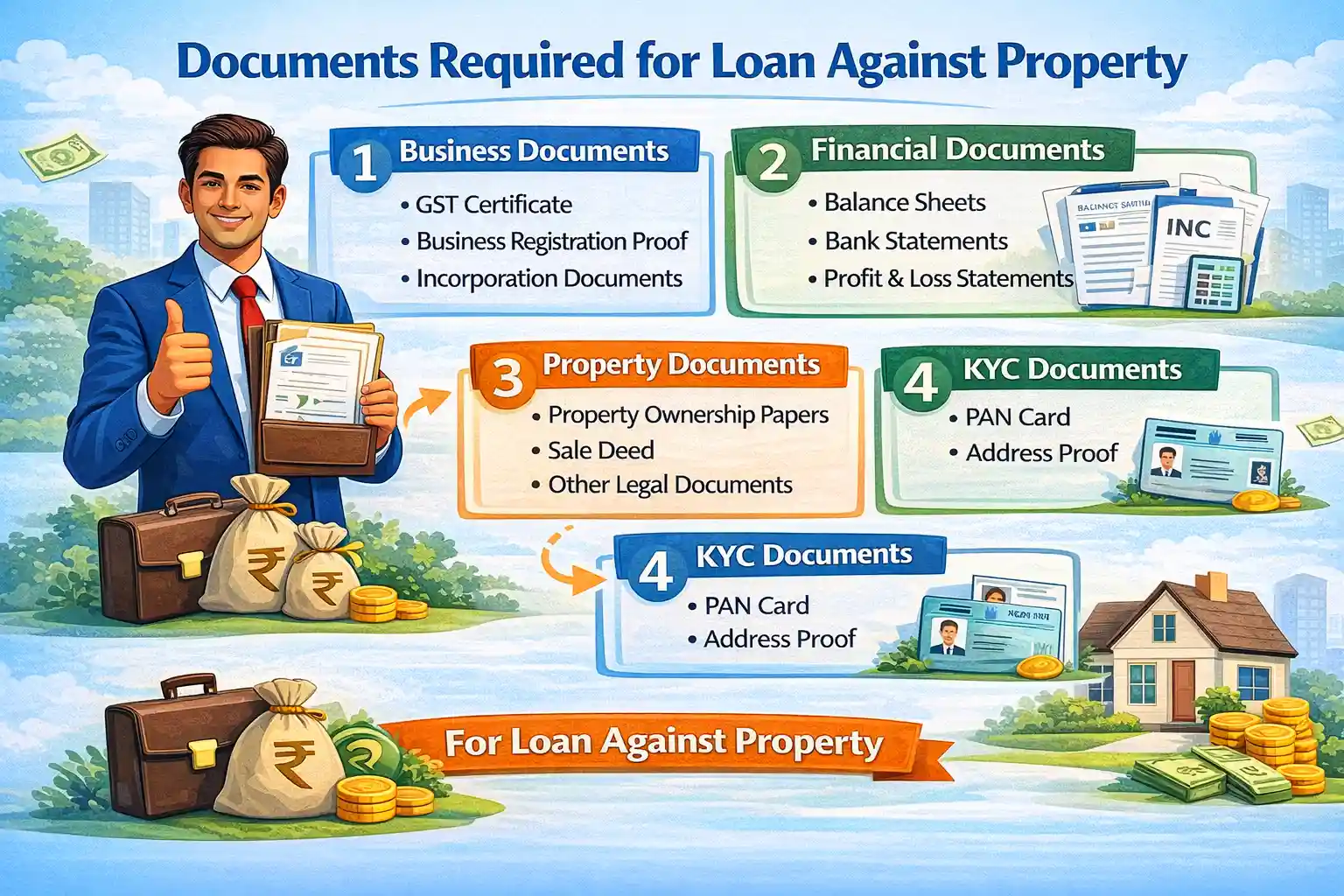

Documents Required for Loan Against Property

To apply for a loan against property for business, certain documents are required to verify the business profile, property ownership, and repayment capacity. Submitting complete documents helps in faster processing of the business loan against property.

Business Documents : Businesses need to provide registration-related documents such as GST certificate, business registration proof, or incorporation documents. These confirm that the business is legally operational.

Financial Documents : Financial records are required to assess repayment ability. These may include bank statements, profit and loss statements, and balance sheets of the business applying for the property loan for business.

Property Documents : Clear property papers are mandatory for a loan against property. These include property ownership documents, sale deed, and other legal papers related to the residential or commercial property being pledged.

KYC Documents : Identity and address proof of the business owner, partners, or directors are required. PAN card and address proof are commonly submitted for a property backed loan.

Providing accurate and complete documents ensures smooth approval and timely disbursal of the loan against property.

Loan Against Property Interest Rate & Charges

The loan against property interest rate for business depends on multiple factors such as property value, business turnover, credit profile, and repayment capacity. Since this is a secured business loan against property, the interest rate is usually lower compared to unsecured business loans.

The interest rate may vary based on whether the property is residential or commercial. A loan against commercial property may qualify for different pricing compared to a residential property used for business funding.

Businesses should also consider other charges related to a property loan for business, such as processing fees and documentation charges. These charges are usually decided at the time of loan approval.

Many lenders provide an estimate using a loan against property interest rate calculator. This helps businesses understand approximate EMIs and repayment structure before applying for a loan against property.

Overall, clear understanding of interest rate and charges helps businesses plan repayments better and avoid financial surprises during the loan tenure.

Loan Against Property Without Income Proof

Many businesses ask whether a loan against property without income proof is possible. In practical terms, lenders mainly focus on the overall business profile, property value, and repayment capacity while evaluating a loan against property.

For a business loan against property, traditional income proof may not always be the only deciding factor. Businesses with strong banking transactions, stable cash flow, or long operational history may still be considered, even if formal income documents are limited.

However, the final approval of a property loan for business depends on multiple factors such as property type, credit profile, and risk assessment. Each loan against property application is reviewed on a case-by-case basis.

It is important for businesses to share accurate details so that the loan structure matches their repayment ability and long-term financial planning.

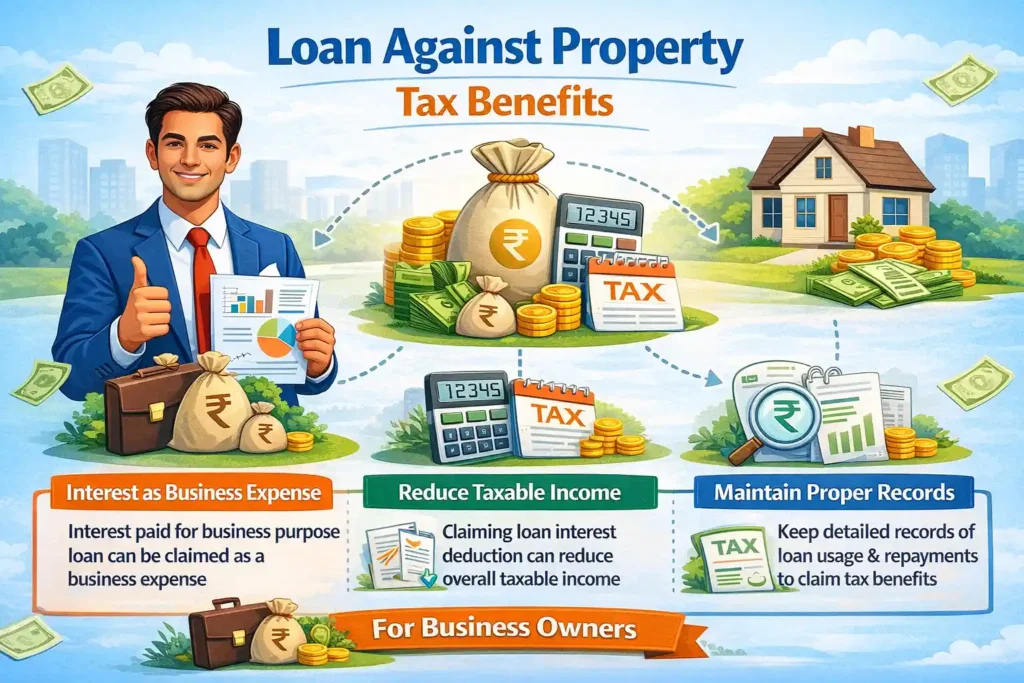

Loan Against Property Tax Benefits

The loan against property tax benefits for business depend on how the borrowed funds are used. When a loan against property for business is taken for business purposes, the interest paid on the loan may be considered as a business expense.

For a business loan against property, the interest component can usually be claimed as an expense while calculating business income, subject to applicable tax rules. This can help reduce the overall taxable income of the business.

It is important to note that tax treatment may vary based on business structure, usage of funds, and prevailing tax laws. Proper records of loan usage and repayments should be maintained for claiming loan against property tax benefits correctly.

Since tax rules can change, businesses are advised to review tax implications carefully before planning long-term funding through a property loan for business.

Loan Against Property vs Other Business Loans

Businesses often compare a loan against property with other business loan options before taking a funding decision. Each option serves a different purpose based on loan amount, tenure, and cost.

Loan Against Property vs Unsecured Business Loan

An unsecured business loan does not require collateral but usually comes with a higher interest rate and shorter repayment tenure. In comparison, a business loan against property offers a higher loan amount, lower interest rate, and longer repayment period because it is secured by property.

Loan Against Property vs Working Capital Loan

A working capital loan is mainly used for short-term operational needs. A property loan for business is more suitable for long-term funding such as expansion, large investments, or debt consolidation.

Loan Against Property vs Personal Loan

Personal loans are not designed for business funding and have higher interest rates. A loan against property for business is structured specifically for business use, making it a more cost-effective and scalable funding option.

Overall, a loan against property is ideal for businesses looking for long-term, stable, and secured funding compared to other short-term business loan options.

Benefits of Loan Against Property for Business

A loan against property for business offers several advantages to companies that need long-term and high-value funding.

One major benefit of a business loan against property is access to a higher loan amount. Since the loan is secured against property, businesses can unlock a significant portion of their asset value.

A loan against property also comes with lower interest rates compared to unsecured business loans. This reduces the overall cost of borrowing and helps businesses manage finances more efficiently.

Another benefit of a property loan for business is the longer repayment tenure. Fixed and extended repayment periods make it easier for businesses to plan cash flow without repayment pressure.

A loan against property provides stable and predictable funding, allowing businesses to focus on operations, expansion, and long-term growth instead of short-term cash constraints.

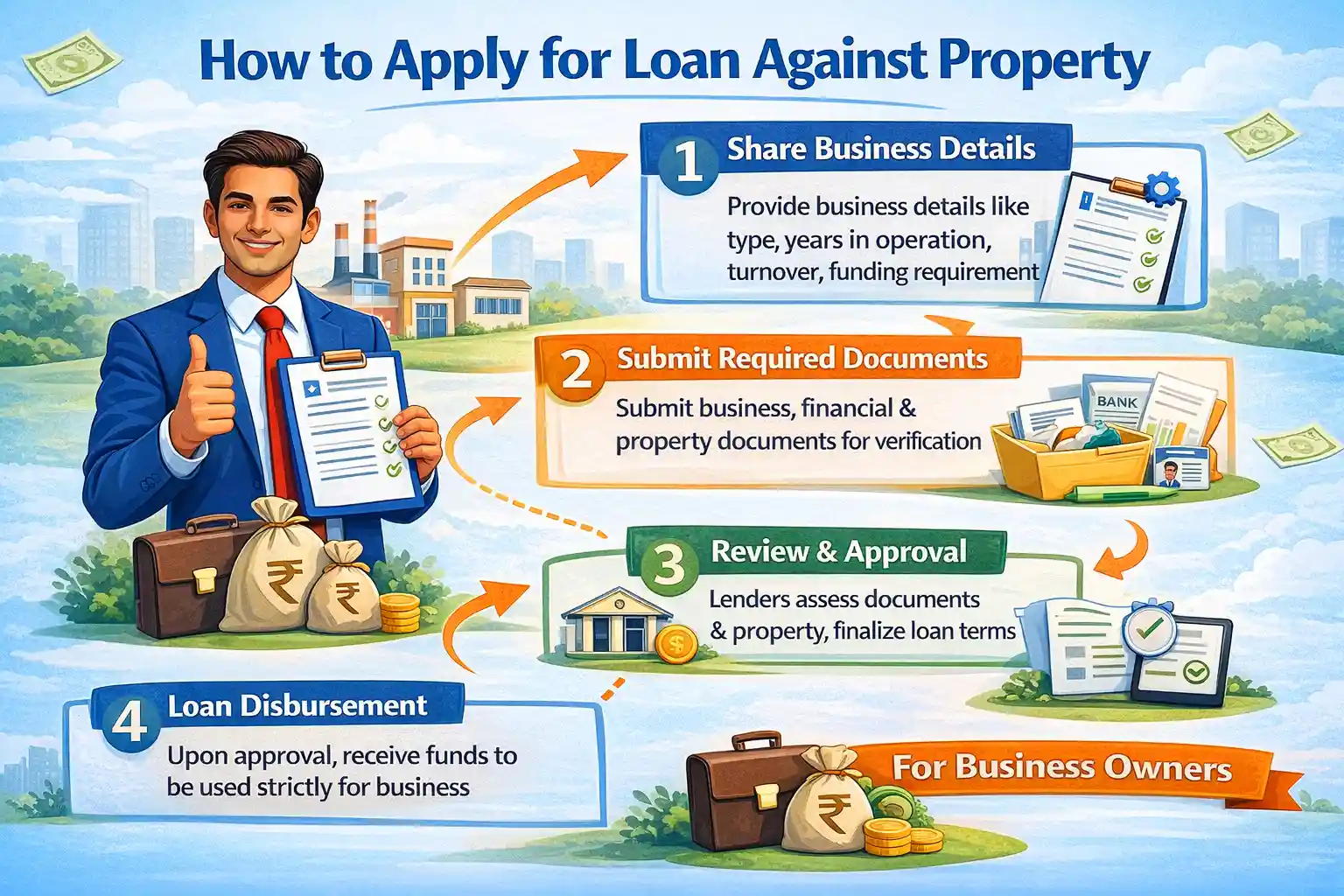

How to Apply for Loan Against Property

Applying for a loan against property for business is a structured process designed to assess both the business profile and the property offered as security.

First, the business shares basic details such as business type, years of operation, turnover, and funding requirement. This helps in checking initial eligibility for a business loan against property.

Next, the required business, financial, and property documents are submitted for verification. These documents help lenders evaluate the value of the property and the repayment capacity of the business applying for the property loan for business.

After document review and property assessment, the loan terms are finalised. Once approved, the loan amount is disbursed and can be used strictly for business purposes.

The repayment of a loan against property starts as per the agreed schedule through fixed monthly instalments, allowing businesses to manage long-term funding smoothly.

FAQs – Loan Against Property (For Business)

What is loan against property for business?

Who is eligible for a loan against property?

Can a loan against property be taken without income proof?

What is the interest rate on a loan against property?

How is EMI calculated for a loan against property?

Are there any tax benefits on loan against property for business?

What type of property can be used for a loan against property?

How long is the repayment tenure of a loan against property?

Get the Right Working Capital Term Loan for Your Business

Running a business becomes easier when cash flow is under control. A working capital term loan helps you manage daily expenses, plan repayments, and keep operations smooth without financial stress. If your business needs reliable funding to handle working capital requirements, now is the right time to take the next step. Apply for a working capital term loan today and get structured financial support that fits your business needs.

Apply For Business Funding

Recent Posts

Contact Us

1204 GD – ITL Building, B- 08,

Netaji Subhash Place, Delhi-110034

Email: ceo@nkbkredit.com

Phone: +91 7503211000,

+91 9654981031

Services

Working Capital Loan

Business Term Loan

Unsecured Business Loan

Machinery Loan

Important Links

Disclaimer

This website functions as a business loan–focused advisory channel supporting individuals and businesses seeking structured funding solutions. Advisory, documentation, and lender coordination services are provided by NKB Kredit Solutions Pvt. Ltd, a registered Indian company offering business finance advisory services.

Copyright © 2026 All Rights Reserved by NKB Kredit Solutions (P) Ltd.